The regular rate of pay is an hourly rate, minimum wage for example, and overtime must be computed on an hourly basis. There is some confusion, however, as to how this apparently simple formula should be calculated under the wage and hour laws and how it relates to key labor laws. Compensating your hourly employees with overtime pay when they work more than 40 total hours per week is more than just showing your team you appreciate their hard work—its federal law. I paid my employee for 43 hours of wages during the last workweek.

Eight of those hours were paid as sick leave, as the employee was out ill for one day. Am I required to pay the employee for three hours of overtime? The required overtime pay is 1.5 times the hourly rate for hours worked in excess of 40 in a workweek.

Overtime is calculated based on hours actually worked, and your employee worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you needn´t count sick leave, vacation time, holidays, or other paid time during which the employee did not actually work. Non-exempt employees are employees that are entitled to minimum wage as well as overtime pay under the FLSA.

Employers are also required to pay these workers an overtime rate of 1.5 times their standard rate when they work more than 40 hours per workweek. A non-exempt employee that is not paid overtime wages can file an FLSA overtime claim through the U.S. Most workers that are paid an hourly wage fall under this category. Unlike other major provinces such as Ontario and Quebec, B.C.

Has both a daily overtime pay threshold and a weekly overtime pay threshold. In B.C., employees are entitled to 1½ times their regular rate of pay if they work more than eight hours in a day or more than 40 hours in a week. However, the overtime pay rate jumps to 2 times the employee's regular rate for every hour over 12 that worked in a day. Should keep a close eye on how long their employees are working in order.

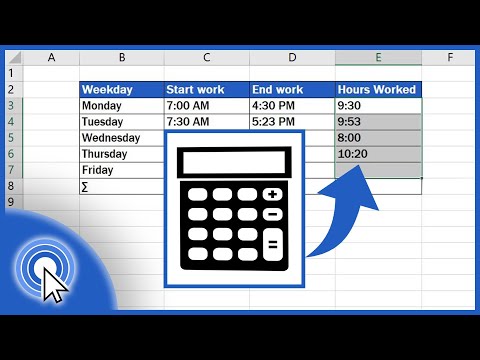

Hours In A Work Week Calculator For purposes of overtime payment, each workweek stands alone; there can be no averaging of two or more workweeks no matter how often the employee is paid. For example, an employee who is paid biweekly will be paid for two separate 40-hour workweeks, and overtime will be calculated accordingly. Overtime is not calculated on an 80-hour work period for an employee paid biweekly. For example, an employee works 39 hours in workweek one of a biweekly pay period and 41 hours in the second workweek.

Whether basic or special overtime rules apply, the formula for calculating overtime pay is the same. Overtime hours are calculated both on a daily and weekly basis, except in a few instances that require overtime to be calculated on a monthly basis. Overtime hours are whichever is the greater number of overtime hours of the daily, weekly, or monthly totals. To properly pay your employees, you must determine their hourly regular rate.

An employee's regular rate of pay is basically straight-time earnings converted to an hourly figure. Calculating the rate can be quite complex if an employee is not paid on an hourly basis for a 40-hour workweek. You'll want to make sure your calculations are accurate so that you're in compliance with minimum wage and overtime laws.

Nonexempt employees may lawfully be paid by means of a salary. These salaried nonexempt employees, however, are still entitled to FLSA overtime pay under overtime laws if they actually work more than 40 hours in a work week. When a nonexempt employee is salaried, the salary must be converted to its hourly equivalent to determine the regular rate of pay for purposes of calculating overtime. My employer paid me for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as I was out ill for one day. Overtime is calculated based on hours actually worked, and in this scenario you worked only 35 hours during the workweek.

Unless a policy, contract or collective bargaining agreement states otherwise, you do not get overtime pay if you used sick leave, vacation time, holidays, or other paid time and did not actually work. Is there a maximum number of hours employees can work during a day? For most adult workers, there are no limits on daily work hours. Theoretically, employers may schedule employees to work seven days a week, 24 hours per day, so long as minimum wage and overtime laws are observed. Manufacturing employees are limited to 13 hours of work in a 24-hour period. There are also daily and weekly limitations on the hours minors can work.

For more information, see the Oregon Wage & Hour Laws handbook. When a non-discretionary bonus covers a period of time longer than a workweek, it must be apportioned back over the workweeks of the period during which it was earned. If it is not possible or practicable to allocate the bonus on the basis of when the bonus was actually earned, some other reasonable or equitable method must be adopted . The employee must then receive additional overtime pay for each workweek in which overtime was worked during the period.

This is done on a workweek basis by dividing the amount of the bonus allocated to a particular workweek by the number of hours worked in that workweek to get the increase in the employee's regular rate. One half of the increase in the regular rate is due for each overtime hour in that week. If the employer pays the overtime premium by allowing the employee to use compensatory time the employee is entitled to use 1.5 hours of compensatory time for each overtime hour worked. Nongovernment employers must also ensure the employee uses the compensatory time within 31 days of when the time is earned.

Workers whose shifts are longer than 8 hours per day, or who have more than 40 hours per week are entitled to overtime compensation. Whatever the case is, overtime hours must be compensated at a 1.5 rate of a worker's regular hourly rate, or higher than that. In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours. That might be just additional money, time off adequate to the number of overtime hours, or other benefits.

When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law. Most employees, including those paid a weekly, monthly, or annual salary, must be paid overtime pay for overtime hours they work. Except where there is a written overtime agreement, an employer must pay an employee overtime pay of at least 1.5 times the employee's regular wage rate for all overtime hours worked. Paying your employees may require some calculations on your part to figure out each employee's hourly rate. In basic terms, an employee's regular rate is his or her straight-time earnings converted to an hourly figure.

Technically speaking, the regular rate is the employee's total weekly remuneration for employment, less statutory exclusions, divided by the total weekly hours worked for which such remuneration was paid. The regular rate is computed before any kind of payroll deduction is made. As a reminder, traditional overtime is time and a half (1.5) of an employee's regular hourly rate. On the other hand, fluctuating workweek overtime is additional compensation of 0.5 times the employee's hourly rate for each hour over 40 worked. Is there a maximum number of hours I can work during a day?

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below.

OT Overtime The Time Card summary shows regular work hours and overtime hours. If the salary component of the employee's wages is equal to or less than the minimum wage, the minimum wage is used for calculating overtime entitlements. However, what if your employees are paid on some other basis, but are still entitled to overtime under wage and hour laws because they worked more than 40 hours?

In these cases you will have to figure out what their "regular rate" is, unless they fall under one of the narrow exceptions to the overtime pay rules. For example, if a nonexempt employee is paid a salary of $400 per week for a normal 40 hour work week, the hourly equivalent is $10 per hour. There may be a dispute, however, as to the number of hours expected from the employee for the salary. The state overtime law applies to most Wisconsin employers, including state and local units of government but not necessarily to each individual worker.

Covered workers, regardless of age, must be paid 1 1/2 times their regular rate of pay for all hours worked in excess of 40 hours a week. To determine your total FTE, add the total part-time hours worked, plus the total full-time hours worked. From there, if your full-time hours are 40 per week, divide the number by 2,080. If your total full-time hours are 30 per week, divide the number by 1,560.

This will give you your total FTE for all full- and part-time employees for the year. You can use the FTE total each week, month, or year to determine company growth. You can also use the FTE total to remain compliant with federal, state, and local labor laws that may be based on employer size such as mandatory sick time laws. In addition to tracking daily and weekly overtime hours, B.C.

Also requires that employers must pay employees extra for working during their rest period. In B.C., employees are entitled to 1½ times their regular rate of pay for overtime hours worked on a statutory holiday. Overtime hours must be paid out at least 1.5 times the employee's wage rate. This overtime rate of pay is multiplied by the total number of overtime hours that employee has worked.

For employees who are paid hourly and work a 40-hour workweek, the calculation is simple and corresponds to the hourly rate of pay that you agree to pay them. However, when employees are not paid on an hourly basis, but instead are salaried or work on a piece rate basis, calculating the regular rate becomes more involved. Is it correct to pay overtime when the employee works more than 80 hours in the two-week pay period?

Your pay periods are irrelevant to the overtime calculation. Pay periods may be established for any period not exceeding 35 days, but overtime must be calculated based on a recurring, seven-day workweek. If a workweek overlaps two pay periods, pay any overtime due for that workweek at the end of the second pay period . For example, if payday is on the 15th and the workweek ends on the 17th, the amount of overtime will not be known for that workweek until the following payday.

In other words, pay the overtime on the 30th -- the regular payday for the period in which the workweek ends. Can my employer offer me "comp" time off instead of paying overtime? Only government agencies are permitted to offer compensatory time in lieu of overtime. If you are a private sector employee, you must received overtime pay when you work over 40 hours in a workweek. Your employer can discipline you for violating its policy by working overtime without the required authorization.

However, wage and hour laws require that you are compensated for hours you work. • Input your hourly wage, normal hours per week, overtime hours, and no. of weeks worked in a year to determine weekly and annual salary. There are basically two ways to calculate the hours per month. With full-time employees, you should assume one employee will work a 40 hour workweek. A quick and easy method of calculating monthly hours is to multiply 40 hours per week by 4 weeks, yielding 160 hours for the month.

Workers can ask their employer for time off in lieu of payment of overtime hours. In such a case, the overtime rate (1.5) is applied, rather than the regular rate. To calculate the total number of hours of leave, each hour of overtime so converted is multiplied by one and one half. Now, you're probably wondering why there is a need for both a daily and weekly overtime pay threshold? In this case, even if they never reached the daily overtime threshold, they would qualify for overtime because they reached the weekly overtime threshold. A somewhat similar system is also used for calculating overtime in Alberta.

Employees must be paid an hourly rate that meets or exceeds the federal or state minimum wage, whichever is higher. The federal minimum wage rate is the minimum rate that must be paid to nonexempt employees for each hour worked up to and including 40 in a calendar workweek. In some states, a higher minimum rate applies and you must pay your employee at least that higher rate. An employee in a position for which a shift differential has been authorized may not have such differential included for overtime compensation unless he or she is assigned regularly to the night shift.

The employer must use the FLSA definition for workweek when calculating overtime. A workweek is defined as a fixed and regularly recurring period of 168 consecutive hours (i.e., seven consecutive 24-hour periods). It does not need to coincide with the calendar week, but may start on any day at any hour that is convenient for the employer. Different workdays and workweeks may be established for different groups or departments to meet the needs of the workers or employer.

Once the workweek is established, it remains fixed regardless of hours worked. The employer is, however, free to change the workweek, provided the changes are permanent and not done to avoid the paying of overtime. The FLSA uses the work week as the standard for computing overtime pay due, and each work week stands alone. Thus, a nonexempt employee's time worked "vests" at the end of each work week . Work time may not be "averaged" from work week to work week. The earnings for all rates for the week are added together, and this total is then divided by the total number of hours worked for the week at all different jobs.

In calculating overtime pay, the number of hours worked each week in the pay period must stand-alone. If an employee worked 35 hours one week and 45 hours the second week of a pay period, the employee would be due 5 hours of overtime premium pay for that pay period. Generally, the exemptions discussed above only apply to "white collar" employees. No matter how highly paid non-management employees in production, maintenance, or construction are, they are entitled to a minimum wage and overtime pay. This includes professions such as carpenters, electricians, mechanics, plumbers, ironworkers, craftsmen, and construction workers. For those who work at a fixed rate without any predetermined hours of work, it is important to check whether they receive at least the equivalent of the minimum wage for all hours worked.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.